Client Satisfaction in Purchasing: A Must or Just “Nice to Have”?

In Sales and Marketing, companies use Customer Satisfaction Surveys to provide indicators of consumer purchase intentions and loyalty. According to Wikipedia, “Customer satisfaction data are among the most frequently collected indicators of market perceptions.” It emphasizes that “[a]lthough sales or market share can indicate how well a firm is performing currently, satisfaction is perhaps the best indicator of how likely it is that the firm’s customers will make further purchases in the future“

In most instances, Purchasing provides services to internal clients, that is, businesses and functions within a company. In other words, unless Purchasing is outsourced, there are no alternative sources for these services. In that case, why we should perform satisfaction surveys?

Client Engagement

In a 2013 article, Are You Engaging All Your Clients?, I gave my view of guiding principles to engaging Clients.

In summary, Client Engagement has four objectives:

- Assuring Strategy Alignment between Purchasing and Client

- Engaging Clients in Sourcing & Project Management

- Engaging Clients in Supplier Management

- Engaging Clients in Target Setting & Performance Management

Much has been written about elevating Purchasing’s stature to gain a “seat at the table” for strategic planning and decision making. I believe that to be considered a Strategic Partner, Purchasing must begin with engaging the Client. Once you engage the Client, you set expectations in their mind and, from there, it makes sense to measure their satisfaction. The comparison of expectation and satisfaction is part of “The Disconfirmation Model” developed by Churchill and Suprenant in 1982 which is based on the comparison of Clients’ expectations and their perceived performance ratings.

Baseline

My view is that you should only start doing Satisfaction Surveys once you have established a Baseline to compare it. The engagement begins by interviewing the main Clients regarding four dimensions: Strategy Alignment, Sourcing Management, Supplier Management, and Metrics.

These questions obtain the Clients’ initial thoughts and scores from 1-6, with the following values: 1 (Extremely Dissatisfied), 2 (Dissatisfied), 3 (Somewhat Dissatisfied), 4 (Somewhat Satisfied), 5 (Satisfied) or 6 (Extremely Satisfied). Note that the scale forces the Client to choose between dissatisfaction and satisfaction alternatives, with no neutral zone.

For each dimension, we have a set of yes-no questions like:

| Strategy Alignment | Is Purchasing part of strategy development and the budget-setting process? |

| Is Purchasing involved in launching new products? | |

| Sourcing Management | Is the Client involved in sourcing strategy development? |

| Has Purchasing informed market trends, benchmarks, and forecasts? | |

| Supplier Management | Is the Client involved in supplier selection? |

| Has Purchasing shared supplier scorecards? | |

| Metrics | Has Purchasing shared savings / avoidances with the Client? |

| Has the Client defined specific metrics for Purchasing? |

The baseline should be performed within each commodity (Raw Materials, Packaging, MRO, Capital, Logistics, etc.), so in the end you will have a baseline score for each commodity and also for all of Purchasing. At this point, you are able to do a gap assessment to understand the expectation from the Clients in each dimension as well as define actions to address the identified gaps.

Satisfaction Survey

Once you have a baseline to start with, you can perform Satisfaction Surveys. I suggest doing the survey just once a year through year-end interviews.

In order to obtain unbiased responses, I suggest selecting purchasing personnel from different commodities, e.g., Raw Materials purchasing personnel will interview Clients from MRO, and so on.

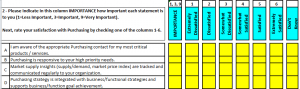

My preferred method of survey is to use a set of statements where the Client can give the Importance to them using Six Sigma ratings: 9 (very important), 3 (important) or 1 (less important). This is coupled with the 1-6 satisfaction scale from above. (See example below.) For statements with scores 3 or below, I recommend asking the Client’s reasoning, so you can identify other gaps to be addressed. At the end of the statements, the final question is the score for the overall satisfaction using the same scale.

Take-Away

Satisfaction Surveys are a must-have tool. Any Purchasing function wishing to be considered a Strategic Partner within the company should be concerned about how its internal Clients are satisfied with the services provided. High-level satisfaction from your Clients is a moving target, and surveys are a way to find your path.

Taking Purchasing to the next level,

Paulo Moretti

Leave a Reply

Want to join the discussion?Feel free to contribute!