Tracking Cost Savings, Capital Reduction, and Avoidance

The words of British engineer Lord Kelvin ring as true today as they did over a century ago: “If you cannot measure it, you cannot improve it.”

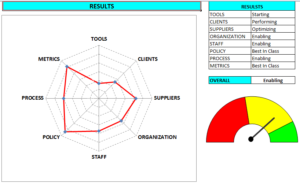

Every field develops metrics in order to understand performance. Such metrics are core elements of Key Performance Indicators (or KPI), which has applications in Purchasing. There, the objective is to improve work processes, programs, methods, or employees, in order to produce results that are effective and efficient. And above all, one metric stands out in Purchasing: Savings.

With consistency, research from universities, consultants, and purchasing associations has shown cost reduction as one of a company’s top three goals for the year. Simply put, Purchasing is the one company function that provides, without fail, fast and large-scale cost reduction.

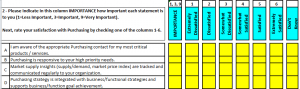

Large companies use complex tools and processes to track and measure cost reduction, while smaller companies may track cost reduction via a simple spreadsheet. Whatever your methods, I recommend using Sourcing Activity and Savings (SAS), shown below. This simple spreadsheet allows you to track Cost Savings, Capital Reductions, Avoidances, Total Procurement Benefits (TPB), and Addressable Spend with ease and transparency.

Economic Concepts

The critical starting point is to work with Finance to define the criteria of each measure. Below are five crucial concepts to understand in the process.

Addressable Spend = The amount of spend that generates reported benefits.

Cost Savings = Also known as EBITDA impact, this is the impact on the income statement relative to the previous period (i.e., previous year). This is the difference between the costs in the previous period and the costs after the sourcing activity.

Capital Reduction = This is the impact on the balance sheet, the difference between the levels that existed before and the levels after the sourcing activity. This can include capital assets, inventory, and payment terms.

Avoidance = This is the price increase avoided, based on forecasted existing price vs. new price paid. It is also called soft savings to reflect the anticipated negative impact on the future Income Statement or Balance Sheet.

Total Procurement Benefits (TPB) = This is the total value created by Purchasing, namely, the sum of cost savings, capital reduction, and avoidances. It is the difference between the outcomes if Purchasing had or had not done the sourcing activity.

Expected vs. Realized Savings

At the time we calculate the benefits from a sourcing activity, we need the best estimate of the quantity expected to be purchased during the first 12 months following full implementation. To calculate the total impact, we need to multiply the quantity times the unit benefit (savings or capital reduction or avoidance). Basically, these are the expected benefits for the 12 months following project implementation.

For example, if the sourcing project is completed in June, then the benefits will be realized between July of the current year through June of the following year. In other words, the tracking of expected benefits and realized savings happen in a different time frame. The expected benefits are shown in the total value in the current year, whereas the realized savings will be shown part in the current year and the rest in the following year.

To be clear, we need to understand that Realized savings will not be exactly equal Expected savings because the Expected savings uses the best estimate of the quantity to be purchased during the first 12 months, whereas Realized savings uses the actual quantity consumed in the period. In my experience, it is not worth the effort to compare estimated quantity vs. actual quantity consumed, as Finance and Business are looking only for an order of magnitude of the savings, so this number does not need to be precise.

The Sourcing Activity and Savings (SAS) tool will track the Expected benefits (the metric to drive behavior in purchasing to perform more sourcing activities) and Realized savings (the impact in the income statement for the current and following year), which Finance and Business want to see.

Sourcing Activity and Savings (SAS)

Inspired by an existing client need, we have developed an SAS Tool where all Purchasing employees can input their sourcing activities to capture expected benefits.

Please click here to download SAS Tool

(For security reasons, the macro was disable. If you want the file please send me an e-mail to paulomoretti@pm2consult.com)

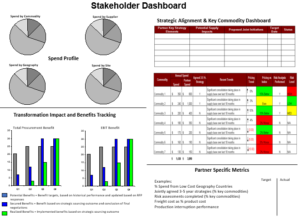

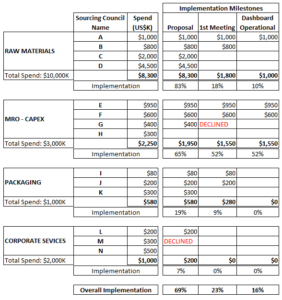

In addition to capturing the Addressable Spend, this tool automatically calculates Cost Savings, Capital Reduction, Avoidances, and TPB. Importantly, it also registers the request for price (RFP) and competitive bids so that leadership can approve the results of each sourcing activity.

Conveniently, there is also a tab that summarizes the results by employee and by commodity, along with the realized savings for the current and following year.

Once the tool and process are implemented, the company is able to report out benefits at any time up to the end of the year. For the following year, leadership is then able to set goals by employee and by commodity in terms of Addressable Spend and Benefits.

Taking Purchasing to the next level!

Paulo Moretti

Paulo Moretti is Principal at PM2Consult.com, a boutique consulting company focused on excellence in the purchasing function and market analysis of Chemicals & Plastics. Current SME assignments include: Efficio Consulting, GEP Consulting, Tenzing Consulting, Preferred Sourcing Solutions, and PLG Consulting.