MEASURING PURCHASING MATURITY

The life of a purchasing executive is filled with doubt. I know because over the years, corporate purchasing managers have bombarded me with questions.

- Do I have the right tools for purchasing?

- Do I have all work processes in place for purchasing?

- Is my staff adequately equipped to perform strategic sourcing?

- Is my purchasing organization designed to meet the company’s needs?

- Which metrics should I have in purchasing?

- Where can I best improve the purchasing function?

From my experience, these questions all have one thing in common: Purchasing Maturity Level. The idea comes from research funded by the U.S. Dept. of Defense to develop the Capability Maturity Model (CMM), where the term “maturity” relates to the degree of formality and optimization of processes: from ad hoc practices to formally defined steps to managed result metrics to active optimization of the processes.

Background

From consultants across the industry, including my friends at AT Kearney, Efficio Consulting, Vantage Partners, and Tensing Consulting, a methodology has developed over the years to diagnose areas of opportunity to improve efficiency and effectiveness in purchasing function.

Each of these groups has developed questionnaires in their areas of expertise to map the strengths and weaknesses of purchasing dimensions like Tools, Internal Clients, Suppliers, Organization, Staff, Policy, Process, and Metrics.

These questionnaires, or tools, help the consultant detect which dimensions might be improved. Based on this diagnosis, the consultant might propose change management, a new process, new tools, or staff training, so that the company can understand where it is now, where it will be, and how it can get there.

My objective with this article is to demonstrate a tool for high-level purchasing executives to create an organizational self-assessment, so they can more fully understand areas for improvement, whether they are able to change by themselves, or whether they need to work with consultants on the areas for improvement. Each consultant will perform their own analysis with more sophisticated methodologies; however, this basic tool here can help executives begin thinking about potential changes for improvement in advance.

Purchasing Maturity Model

The model consists of a spreadsheet with eight dimensions to consider for purchasing maturity: Tools, Clients, Suppliers, Organization, Staff, Policy, Process, and Metrics. Each Dimension has several elements to be scored. For each element, users can select via the drop-down button the score that most closely reflects the purchasing function: 0, 1, 2, or 3 (with 3 rated as Very Mature). The score for each element has a description to guide user assessment. After scoring all 55 elements, the Result tab will show the maturity level in each dimension and the overall result for the Purchasing function.

This model divides the purchasing function into three levels with these descriptions:

- Starting / Performing: Purchasing is not a core competency. It is buried deep in the organizational hierarchy. Clients and Suppliers avoid interaction. Staff actively disengaged.

- Enabling / Optimizing: Purchasing is seen as a “value-added” function. There is some executive support and investment. Clients and Suppliers are satisfied for the most part. Employees are engaged but view this as a “job.” There are some spot best practices.

- Best in Class / World Class: Purchasing is strategic core competency. The organization is proficient at expected business practices. There is a high degree of Client and Supplier satisfaction. The organization is staffed with highly qualified professionals. There is a high degree of automation. It is metrics driven. It is an efficient and effective organization.

Results

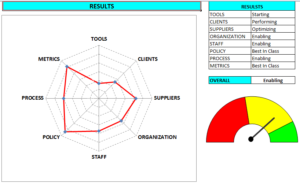

The results of each analysis are presented in graph form for the eight dimensions, as well as the maturity level for each dimension, in a “maturity meter” with the overall classification, as shown below.

From the above example, the purchasing executive would have a clear view that the first priorities for improvement are Tools and Internal Clients, and then the second priority is for Suppliers, Organization, and Staff. Of course, some changes in assessment may affect different dimensions, but consultants would know the best approach to most effectively implement changes.

After applying the tool, let me know if you have any questions.

Taking Purchasing to the next level,

Paulo Moretti