Supplier Segmentation Tools Help Drive Procurement Productivity

Today’s blog draws a comparison between Marketing & Sales and Purchasing in relation to the critical factor of segmentation. The overall objective of segmentation is to identify high-yield segments, that is, those segments most likely to be profitable or show good growth potential. According to Wikipedia, “Market segmentation assumes that different market segments require different marketing programs – that is, different offers, prices, promotion, distribution, or some combination of marketing variables.”

In our case of B2B, Marketing & Sales performs a customer segmentation in order to compile a group of customers (or segments) that presents shared characteristics like similar industrial applications, comparable needs, common interests, and similar buying behavior, among others. After the segmentation, Marketing & Sales may implement Customer Relationship Management (CRM), a process of managing a company’s interaction with current customers, specifically designed for each segment.

On the other side of the table, we notice Purchasing treating all suppliers similarly, although I believe the customer segmentation rationale should be the same for Purchasing as with Marketing & Sales; that is, a company’s different suppliers should be treated differently. Without a doubt, all suppliers must be treated with respect and high ethical standards. However, the attention level, communication, and frequency of communication to each one should be different, involvement of purchasing leadership and stakeholders should be different, and most important, the negotiation and purchasing strategies should be different too because the key drivers are different.

According to the Procurement Strategy Council, “On average, purchasing organizations spend 60% on sourcing activities and less than 20% actively managing supplier value.” That’s where Supplier relationship management (SRM) comes into play.

What is SRM?

Supplier relationship management, according to Wikipedia, is “the systematic, enterprise-wide assessment of suppliers’ assets and capabilities with respect to overall business strategy, determination of which activities to engage in with different suppliers, and planning and execution of all interactions with suppliers, in a coordinated fashion across the relationship life cycle, in order to maximize the value realized through those interactions.”

Before implementing SRM with an Account Manager and Account Plan, then, you must segment your suppliers in order to define which ones are considered strategic to your company. In this case, a Supplier Segmentation Tool will provide invaluable help in this process.

Segmentation

The first step is to ask your buyers, purchasing manager, and director to list 5 strategic suppliers. The next step is to ask why they are strategic. This is when the revelations begin as each of them gives their own rationale – or more often, mere gut feeling – and criteria can then be examined in the open.

Strategic suppliers, by definition, are those who are strategic to the entire company, however your company chooses to define its strategy. Therefore, the supplier segmentation should be done at the highest commodity levels, i.e., Raw Materials, Packaging, MRO, Logistics, and Corporate Services. The benefits of supplier segmentation are many, as outlined below.

- Enables better resource allocation by:

- assigning appropriate people to each segment

- guiding Purchasing time management within Suppliers

- assuring leadership time with important Suppliers

- Defines engagement model for each Supplier segment by:

- enabling alignment within Purchasing and also stakeholders

- defining roles, activities, and frequency of engagement

- identifying which Suppliers receive Collaboration

- Defines tactics model by:

- guiding sourcing and negotiation strategy

- guiding communication level and frequency

- guiding performance management level

The Tool

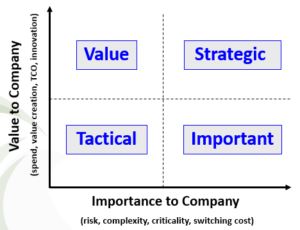

The tool I have developed has two dimensions, VALUE (y-axis) and IMPORTANCE (x-axis) and creates four quadrants (shown below). Value includes tangible elements like Spend, EBIT, Revenue Impact, TCO, and more. Importance includes less-tangible elements like Risk, Complexity, Impact, Service Disruption, and others.

For both dimensions (Value and Importance), there are 13 Criteria that you designate as High, Medium, or Low. The tool allows you to also create your own criteria and scale if you wish.

For each highest level of commodity (e.g., Raw Materials) you select from 3 to 5 criteria where your suppliers will be evaluated. For each criterion, you input the weights: 9, 3, or 1 (high, medium, or low), and you must use all weight levels (that is, you cannot choose level 9 across the board). Next, you add all suppliers to be evaluated against the criteria, along with their respective annual spend. As a team (which may include stakeholders), you will agree on a score (9,3,1) for each criterion for each supplier.

Once all suppliers are scored, the tool will segment each supplier into one of the four segmentation groups available:

Strategic: High Value / Very Important, Important: Very Important / Low Value, Value: High Value / Not Important, Tactical: Low Value / Not Important

The tool will list all suppliers in their respective segments. The segmentation tool will calculate the overall score for each supplier. (Scores are not shown because the numbers do not have specific meaning). The overall score, then, is compared to the average in each dimension in order to position each supplier within a quadrant.

If the scores for suppliers are close to each other, you may have more or fewer strategic suppliers than you would like to have, but the tool is flexible, so you can alter the number of strategic suppliers by changing the sensitivity analysis. This sensitivity can change the average position from -30% to +30% (of the dimension average).

Once you have your suppliers segmented, you must allocate your resources accordingly. This will require you to 1) define which engagement model you should pursue within each segment, 2) define the tactics of communication level, frequency, and performance management, and 3) define sourcing and negotiation strategies for each segment.

Take-away

An old Purchasing axiom comes to mind: “Not all suppliers are created equal.” Recalling this wisdom reminds us that we select different suppliers using our keenest purchasing lenses, with each them being treated differently according to each of our company’s interests. Segmenting our supplier base is the first step to allocating resources and treating them according to each their appropriate segmentation. The benefits of supplier segmentation for your company is achievable through better relationships, cost reduction, and value creation.

Taking Purchasing to the next level,

Paulo Moretti