Engaging Purchasing Stakeholders: A Framework that Works

The recent Deloitte Global CPO survey 2018 contained several surprising results. Foremost among them for me was the low level of purchasing engagement between businesses and functions, that is, the purchasing stakeholders.

Purchasing stakeholders, by my definition, are the people in businesses or functions who are affected – either positively or negatively – by purchasing actions and decisions. Therefore, if the stakeholders are affected, it is imperative that you, the purchasing professional should actively engage with them.

The CPO Survey revealed that only “22% of procurement leaders are excellent business partners contributing significant strategic value.” It was also found that only one-third have “good transparency” at levels below the Tier 1 suppliers.

This same survey further revealed that 76% of procurement leaders use only one approach to understand stakeholder requirements: the procurement team members who are embedded in cross-functional teams. In my view, this reactive approach is harmful to the purchasing function. Instead, we need a more proactive framework to define stakeholder engagement.

In the discussion below, we will identify stakeholders, justify engagement, and provide notes on a framework, approach, and governance.

Who are the stakeholders?

First, we need to identify the primary stakeholder in each commodity.

Organization designs for purchasing may vary, but most of them are divided into Direct and Indirect spend. Raw Materials and Packaging (RM & Pack) are commonly seen as part of Direct spend; Indirect spend typically includes Maintenance, Repair, Operation (MRO), Capital Expenditure (CAPEX), and Corporate Services. Logistics is divided between Direct (with freight costs from Truck, Rail, or Marine in RM & Pack) and Indirect (when freight is related to the sell side).

For RM & Pack, the primary stakeholders are the Business Director or Marketing Director. These are the people accountable for the profitability of the business when RM & Pack are the main input affecting the profitability.

For MRO/CAPEX, the primary stakeholders are Maintenance Leaders, Engineering Leaders, and ultimately the Plant Director. For Corporate Services, the primary stakeholders are the Function Leaders where we have a significant spend in IT, HR, Legal, Marketing, EH&S, Travel, and others. Finally, for Logistics, the stakeholders are Supply Chain Leaders.

A more traditional way to find the stakeholders has been to wait for something to go wrong in purchasing and notice whom to point fingers at. This failed approach underscores the importance of proactivity in stakeholder engagement.

Why stakeholder engagement?

Since stakeholders are affected by your decisions and actions, it is essential to engage with them. As I see it, there are four primary objectives in stakeholder engagement related to the actions and decisions made by purchasing.

- Assure strategic alignment between Purchasing and stakeholders

- Engage stakeholders in sourcing and project management

- Engage stakeholders in selection and supplier management

- Engage stakeholders in target setting and performance management

Following are five common concerns related to engagement (or the lack thereof).

- Is purchasing aware of strategic business moves that can affect the supply chain?

- Is purchasing informed about demand growth so that needed materials can be acquired on time?

- Are stakeholders informed about supply market insights and price movements?

- Are stakeholders aware of supplier performance?

- Are stakeholders informed when their main product is being sourced?

Framework

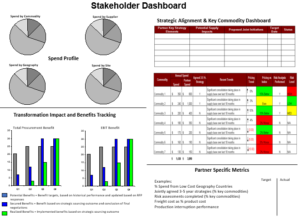

Our framework is a simple, structured mechanism that is not time consuming for stakeholders. The model below can be used with any commodity with two levels of engagement. The higher level is the Steering Team, composed of the VP of Purchasing, the Purchasing Director, and the Business Unit President (or Function Head). The lower level, the Sourcing Council, is where most of action will take place.

Approach

Purchasing leadership should identify potential Sourcing Councils according to three criteria: significant spend, observed misalignments, and strategic impact on the organization. For accountability purposes, purchasing leadership should name one person to each Sourcing Council who is most knowledgeable about that area’s main products or services.

The selected person will prepare a presentation that includes Objectives of Engagement, Engagement Model, scope with defined purposes, and potential Sourcing Council Dashboard to be used. That person will then set up one meeting with stakeholders to make the proposal to create the Sourcing Council.

If a stakeholder decides to not engage in this model, the purchasing professional will at least have done his/her part in proposing the engagement, with the knowledge that the Purchasing stakeholders have been properly advised. On the other hand, if the stakeholder decides to engage, then quarterly meetings can be defined and stakeholders can decide what belongs in the Dashboard (see example below).

Governance

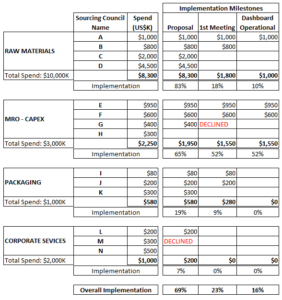

In order to track the progress of the sourcing councils, the Steering Team should create a quarterly mechanism to capture major implementation milestones. These would include when the proposal was done, when the first meeting happened, and when the Dashboard became operational (as shown in the example below for one specific quarter).

By using this tracking system, the Steering Team will know how much spend is possible according to Sourcing Councils, and then by each quarter, the degree of completion for proposals, first meetings, and Dashboard operationality. Once the Sourcing Councils are operational, the Steering Team is only advised when a Sourcing Council has critical matters to report.

Take-away

It is clear from the CPO Survey 2018 that there is a lack of engagement between purchasing and stakeholders. In order to change this picture, we need to be proactive and create a structured mechanism that aligns with stakeholder strategies, provides market insights, and has stakeholders participating in the sourcing activities, so that both sides can enhance the value delivered to the organization.

Taking Purchasing to the next level,

Paulo Moretti

The problem of comparing sales unit price with RM unit price is that both must be in the same UOM for accurate comparison. In order to meet this need, Purchasing AlertaTMwas developed to translate almost all UOMs, from sales and purchasing, into one measurement, allowing users to compare apples with apples.

The problem of comparing sales unit price with RM unit price is that both must be in the same UOM for accurate comparison. In order to meet this need, Purchasing AlertaTMwas developed to translate almost all UOMs, from sales and purchasing, into one measurement, allowing users to compare apples with apples. Following accounting rules in any country, any sale of a product is registered into the system in the correct business. Likewise, any raw material used to manufacture that product is also registered in the same business. Purchasing AlertaTM was developed to link both sales and purchasing in the same manner, at any level desired.

Following accounting rules in any country, any sale of a product is registered into the system in the correct business. Likewise, any raw material used to manufacture that product is also registered in the same business. Purchasing AlertaTM was developed to link both sales and purchasing in the same manner, at any level desired.  Through a drop-down tool, you can select any business level, according to the existing business structure, and the graph will display the data accordingly.

Through a drop-down tool, you can select any business level, according to the existing business structure, and the graph will display the data accordingly. This tool also calculates other relevant information: Impact on sales (total purchasing costs divided by the total sales, for each selected business) and Percentage of products translated to the same unit from all UOM in the ERP system.

This tool also calculates other relevant information: Impact on sales (total purchasing costs divided by the total sales, for each selected business) and Percentage of products translated to the same unit from all UOM in the ERP system.